Oregon Clean Vehicle Rebate Program

Application Packet

Thank you for your interest in the Oregon Clean Vehicle Rebate Program! Enclosed you will find the Terms and

Conditions, and Rebate Application Form. Please read the Terms and Conditions carefully to understand Program

requirements.

Standard and Charge Ahead Rebates

You may apply for the Standard Rebate, the Charge Ahead Rebate or both. Rebate amounts vary based on eligible

vehicle technology type and income. Eligible vehicles and the income eligibility calculator can be found on the

program website.

Rebates depend on program funding at the time of vehicle purchase or lease. Visit the Available

Rebate Funding page before your purchase or lease to confirm rebate availability.

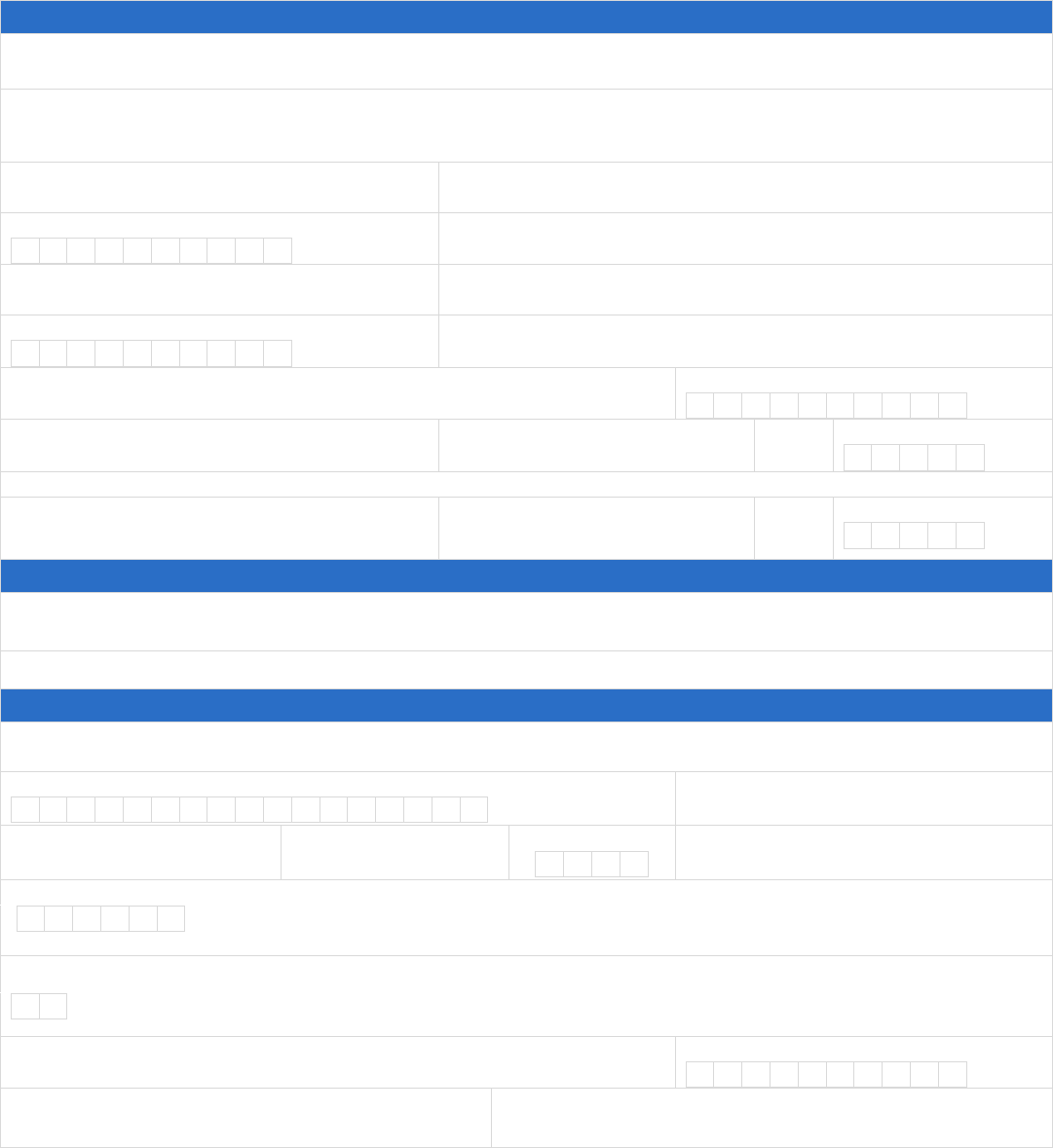

WHO QUALIFIES? STANDARD REBATE

CHARGE AHEAD REBATE

(purchase or lease on or

after Jan. 1, 2022)

Eligible Applicants

Oregon residents, businesses, nonprofits

and government agencies

Oregon residents, low-income

service providers

Qualifying Vehicles

New battery electric vehicles and plug-

in hybrid vehicles

New or used battery electric

vehicles and plug-in hybrid

vehicles

Rebate Amount

$750 for zero-emission motorcycles

$1,500 for battery under 10 kWh

$2,500 for battery 10 kWh or more

$5,000

Income Requirement No income requirement

Up to 400% of the federal

poverty guideline

How to Apply – 4 Steps

1. Read the Terms and Conditions carefully (pages 3-8). Confirm your vehicle qualifies by referring to the list

of eligible vehicles linked on the program website.

2. Fill out and sign the Rebate Application Form (pages 8-10).

3. Include a copy of all Required Documents (see page 5 of the Terms and Conditions). These include:

☐ Proof of Oregon Residency

☐ Complete Purchase/Lease Agreement

☐ Proof of Vehicle Registration (temporary or permanent)

☐ Local business license, articles of incorporation or other formation document filed with the Oregon

Secretary of State (Businesses, nonprofits and government agencies only)

☐ 501(c)(3) nonprofit determination letter from IRS (Charge Ahead, low-income service providers

only)

4. Mail your completed and signed Rebate Application Form and all required documents to:

Center for Sustainable Energy

ATTN: Oregon Clean Vehicle Rebate Program

3980 Sherman Street, Suite 170

San Diego, CA 92110

Page 2 of 10 Updated : March 15, 2023

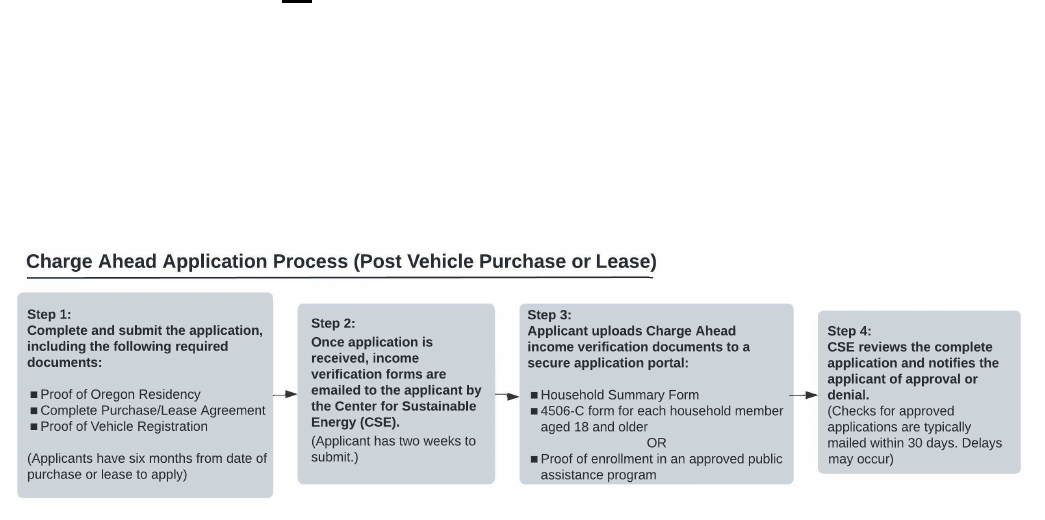

Income Verification Required After Application is Received (Charge Ahead)

5. If applying for the Charge Ahead rebate, you must provide proof of income. After your application and

required documents (see #3 above) are received, you will be sent an email from

oregoncvrp@energycenter.org with the below forms attached. Complete and upload them to the secure

document portal.

The below documents do not need to be included in the initial application.

☐ Household Summary Form (Charge Ahead Only)

☐ Proof of Income (Charge Ahead Only). Form 4506-C for each household resident aged 18 and older OR

proof of applicant’s enrollment in a Public Assistance Program

NOTE: Low-income service providers applying for Charge Ahead will not need to provide proof of income

or the Household Summary Form.

If you have questions about the Terms and Conditions or filling out the application, please contact us at

OregonCVRP@energycenter.org, or call us at 855-383-4425.

Alternative formats

The Department of Environmental Quality can provide documents in an alternate format or in a language other

than English upon request. Please call DEQ at 800-452-4011 or email deq[email protected].

Page 3 of 10

Oregon Clean Vehicle Rebate Program

UPDATE: Due to overwhelming demand and limited funding, rebates will be suspended as of May 1, 2023.

Any vehicles purchased or leased on or after May 1, 2023, will not be eligible to apply for the rebate once

the program reopens. Once funding is available again, the program will announce its reopening. For more

information, read the news release.

Terms and Conditions

As a condition of participation in the Oregon Clean Vehicle Rebate Program (“the Program”), the Applicant

must adhere to and comply with the Terms and Conditions and any other requirements imposed by law, even if

assigning a rebate to a Participating Dealership. Applicants are responsible for reviewing the Terms and

Conditions prior to applying for a rebate.

DEQ will only issue rebates to Applicants who meet the Terms and Conditions, which include requirements as

laid out in Oregon Administrative Rule Chapter 340, Division 270, and under Oregon law. This document is

intended to explain the administrative rules and statutory requirements that apply to the Program.

Part 1: Applicant and vehicle requirements

Applicant must meet requirements that include, but are not limited to:

1. Applicant must be an Oregon resident, an organization such as a business, nonprofit, public entity or

Oregon state or municipal government entity based in Oregon or with a current Oregon-based affiliate, or a

low-income service provider that provides health, dental, social, financial, energy conservation or other

assistive services to low- or moderate-income households in Oregon. All businesses and nonprofits must

be licensed to operate in Oregon. All low-income service providers must be registered as a 501(c)(3)

organization based in Oregon or have an Oregon-based affiliate. Businesses, nonprofits, government or

public entities are limited to ten (10) rebates per entity per calendar year.

2. Applicant must submit an application within six (6) months of the date of purchase or lease of an eligible

vehicle. For the purposes of the Program, the “date of purchase” is the date the purchase contract or

security agreement is executed and signed. For the purposes of the Program, the “date of lease” is the date

which the lease agreement is signed.

a. For Tesla and other vehicles ordered without a standard purchase/lease agreement, the date of

purchase or lease is the first date of vehicle registration. Applicants must take delivery of their

vehicle before submitting a rebate application.

3. If applying for a Charge Ahead Rebate, the household income must be less than 400% of the federal

poverty guideline. Income eligibility will be verified for the year the vehicle was purchased or leased. If

that income information is unavailable or inadequate, income eligibility will be verified from a previous

year. All income verification documentation must reflect the name of the Applicant.

4. The purchase or lease of an eligible new or used vehicle must comply with Oregon Administrative Rule

Chapter 340, Division 270. Eligible vehicles are identified on the Program website.

a. Vehicle must be purchased or leased from a certified dealership or an original equipment

manufacturer (“OEM”). If a vehicle is purchased through an OEM, the OEM cannot have any

licensed, franchised, new automobile dealerships in Oregon.

5. Standard Rebates are only available to new vehicles. Vehicles are only considered new if they have not

been previously registered. Vehicles that were previously used as dealership floor models and test drive

vehicles (“demo vehicles”) are eligible for a rebate only if they have not been previously registered.

Page 4 of 10 Updated : March 15, 2023

Vehicles determined by the Oregon Clean Vehicle Rebate Program Administrator (“the Administrator”) to

be unrebated rollback or unwind vehicles are considered new vehicles. Vehicles that have already received

a rebate are not eligible for another Standard Rebate, unless the full amount of the original rebate was

returned. The Applicant is responsible for verifying in advance that the vehicle has not previously received

a rebate.

6. If applying for a Charge Ahead Rebate and purchasing a used vehicle, Applicant attests that they have not

previously owned or leased the vehicle. Applicant must provide all information requested to confirm the

Applicant is not buying, selling or leasing vehicles in a manner that circumvents the intent of the Charge

Ahead Rebate Program.

7. Applicant must retain ownership of the vehicle for a minimum of 24 consecutive months immediately

following the date of vehicle purchase or lease (“Ownership Requirement”) and register the vehicle for use

in the state of Oregon with the Oregon DMV for that entire ownership period. For leased vehicles, the

original lease term must be a minimum of 24 months.

a. Applicant is required to notify the Administrator in advance of the intent to sell, return or

terminate a lease in order to arrange for early termination of vehicle ownership and Ownership

Requirement.

b. If Applicant violates the Ownership Requirement, they agree to remit the rebate to the Program,

either in full or a pro-rated amount of the rebate, as determined by the Administrator. DEQ or its

designee reserves the right to recoup all rebate funds from the Applicant and may pursue other

remedies available under the law.

c. Obtaining the rebate at the point of sale from a Participating Dealership does not alleviate

Applicant’s responsibility to remit the rebate funds to the Program if the Ownership Requirement

is not met.

d. Applicant must be available for follow-up inspection if requested by DEQ, or DEQ’s designee, for

project oversight and accountability.

8. Applicant certifies that they will not make or allow any modifications to the vehicle’s emissions control

systems, hardware, software calibrations or hybrid system. Applicant certifies that they will participate in

ongoing research efforts and surveys that support the Program goals, upon request from the Administrator.

9. For business, nonprofit, public entity and Oregon state or municipal government Applicants, annual

vehicle usage reports must be submitted to the Administrator for all rebated vehicles for a period of at least

24 months. Report data may include, but is not limited to, mileage reporting and annual fuel use by fuel

type.

Part 2: Application process

To apply for a rebate, submit an application and all required documentation within six months of the purchase or

lease date of the vehicle. Mail application and required documentation to the Program Administrator:

Center for Sustainable Energy

ATTN: Oregon Clean Vehicle Rebate Program

3980 Sherman Street, Suite 170

San Diego, CA 92110

Applicant must be an Oregon resident, an organization such as a business, nonprofit, public entity or Oregon

state. Submission date for mailed applications is determined by U.S. mail postmark. For security purposes,

required documents sent on removable media (flash drives, CDs, DVDs, etc.) or email will not be accepted.

Page 5 of 10 Updated : March 15, 2023

Program communications will be sent via email. They may include requests for additional documentation or

information. It is the responsibility of the Applicant to submit a correct email address in the application and

ensure it allows emails from the Program. Applicants are responsible for emails sent from the Program.

Applicants are encouraged to add oregoncv[email protected]rg

to their Safe Senders list, and review Spam and

Junk folders for emails from the Program. Applicant understands that notices will be sent via email and it is their

responsibility to check all OCVRP related emails. Applicant understands that their application will be cancelled

if they do not provide required supporting documentation within the required timeframe.

Required documentation

1. Application forms must be completed, signed and dated by the Applicant or their legally authorized

representative. Authorized representatives are required to supply documentation to demonstrate their

authority to sign on the Applicant’s behalf. Applicant must contact the Administrator immediately if there is

a mistake on the application form. Applicants who submit an application form with an incorrect Applicant’s

name will need to reapply.

2. Proof of temporary or permanent Oregon vehicle registration for the vehicle listed in the application. The

Applicant’s name must be on the registration, and the registration must be current (not expired).

3. A complete copy of the vehicle sale or lease contract executed and signed, with all pages included. A

complete contract includes an itemization of credits, discounts and incentives received, if applicable. The

Applicant’s name and the name of the dealership must be listed on the contract.

4. Proof of Oregon residency:

a. For individuals, including Oregon residents, trusts, Doing Business As (DBAs), and Sole

Proprietorships, a copy of the Applicant’s current (not expired) Oregon driver’s license. For DBAs

(also known as fictitious business name, assumed business name or trade name), a document

linking the individual to the DBA is required. Individuals who do not have an Oregon driver’s

license will be required to provide proof of Oregon residency in the form of one of the following

(The Administrator will reach out to confirm this.):

i. A utility or cable bill from the last three months.

ii. A copy of the current DMV registration of another vehicle in the name of the Applicant.

Registration for a Planned Non-Operational vehicle does not meet this requirement.

iii. A signed, dated and notarized residential rental agreement.

iv. Other valid form of identification demonstrating Oregon residency as approved by DEQ.

b. For an organization, such as businesses, nonprofits or public or government agency: A copy of a

local business license, articles of incorporation or other formation document filed with the Oregon

Secretary of State.

5. Proof of income

1

, for all Charge Ahead applications:

a. Proof of enrollment in an eligible income-qualified program (“Categorical Eligibility Program”) at

the time of vehicle purchase or lease.

OR

1

This information will be requested separately and does not need to be mailed in with the original application.

Page 6 of 10 Updated : March 15, 2023

b. A completed Household Summary form reflecting household size AND a completed IRS Form

4506-C for every household member aged 18 and older living in the household at the time of

vehicle purchase or lease, regardless of filing status or dependency. If Applicant’s tax transcript

for the year of vehicle purchase or lease is not available, additional documentation will be required

to verify income.

c. For low-income service providers, in lieu of the above, a 501(c)(3) nonprofit determination letter

is required.

Application review process

All eligibility will be reviewed based upon the Oregon Administrative Rule Chapter 340, Division 270 and

Oregon statute in place at the time a new application is submitted. An Applicant must provide all additional

information and documentation requested by the Administrator or DEQ to determine eligibility. If additional

documentation is required, Applicant has 14 calendar days to submit it to the Administrator.

Program communications will be sent via email. They may include, but are not limited to, requests for additional

documentation or information.

Applications that do not meet program requirements or submit required documentation within the timeframe

allotted will be cancelled and reserved rebate funds will be released to the Program. Notification will be sent to

the email address on file to notify Applicant of the cancellation. If the application is cancelled, Applicant is

responsible for submitting a new application. If the new application falls outside of the Applicant’s eligibility

window, the application will be ineligible. Extensions will not be granted.

Appeals

Applicants may appeal the cancellation in writing to DEQ within 60 days of the date of the cancellation. The

appeal letter must set forth all facts that form the basis for the appeal, including why the Applicant believes that

the statute or rules have been misapplied or otherwise improperly cancelled the application. Please send your

appeal letter to the following address:

Oregon Department of Environmental Quality

ATTN: OCVRP Appeal

700 NE Multnomah Street, Suite 600

Portland, OR 97232-4100

DEQ will respond to all appeals of cancellation in writing. If the only basis for an appeal is that the Applicant

disagrees with the policies set forth in the Terms and Conditions and Oregon Administrative Rule Chapter 340,

Division 270, DEQ will deny the appeal. DEQ’s response will constitute an order in other than a contested case.

Part 3: Rebate payment

Rebate funds are reserved at the time of application submission. All required documentation must be provided

during the application process or rebate funds will not be reserved. Application submission does not guarantee

availability of Program rebate funds. Rebates are disbursed on a first-come, first-served basis, prior to the

exhaustion of Program funds.

Applicants that request a rebate check must cash it within two (2) years of the date on the check. Checks not

cashed within this timeframe will be cancelled, and the rebate funds will be returned to the Program.

Page 7 of 10 Updated : March 15, 2023

Public records disclosure:

By submitting your application, you agree to share all information provided as part of your application, including

personal information included on your application. “Personal Information” includes an individual’s name,

address, email address, social security number, driver license number, household income, telephone number,

racial identity, ethnicity, age and gender identity. Personal information will be shared with the following parties

for the allowed uses described:

1. The Center for Sustainable Energy to contact you, process your rebate and enforce the program Terms

and Conditions.

2. The Oregon Department of Environmental Quality, Oregon DMV and the Oregon Treasury to administer

the Program, distribute your rebate funds and enforce program Terms and Conditions.

3. Any other parties as required by Oregon Public Records Law, ORS 192.385 to ORS 192.338.

DEQ depends on personal information to efficiently process rebate applications for the Program. DEQ values the

information submitted and believes that applicants’ willingness to provide this information is in the public

interest because it allows DEQ to issue rebates as efficiently as possible.

Oregon DEQ is not able to guarantee confidentiality. Personal Information submitted in this application is

considered public record and subject to disclosure as required by Oregon Public Records Law, ORS 192.385 to

ORS 192.338. Thus, Personal Information included on the application may be subject to disclosure under the law

in response to a public records request. Personal Information that is made confidential under federal law is

exempt from disclosure under the Oregon public records law.

If you indicate that you would not submit the information but for a promise of confidentiality from DEQ, DEQ

will make its best efforts to keep the information confidential. If DEQ receives a public records request under

which this rebate application is deemed a responsive record, it will carefully analyze any submission to

determine if it is exempt from disclosure under the Oregon Public Records Law. DEQ will make its best effort to

withhold records where the applicant requested confidentiality, while at the same time being mindful of its

obligations under the Public Records Law.

By submitting your application, you agree to complete the Program Participant survey. Information you provide

will not be used for commercial purposes. The information, including personally identifiable information, will be

used by the Center for Sustainable Energy to conduct research for the purposes of improving the

Program. Information you provide, including personally identifiable information, may also be used for academic

research purposes by DEQ.

Oregon DEQ will securely store your data for six years from the date of application or other date as mandated by

Oregon Administrative Rule Chapter 340, Division 270.

Consent:

By submitting your application, you acknowledge that you have read, understand and agree to the program

Terms and Conditions.

If you have questions about the Terms and Conditions, or about filling out the application, please contact the

Administrator at 855-383-4425 or OregonCVRP@energycenter.org.

Page 8 of 10

Oregon Clean Vehicle Rebate Program

Standard and Charge Ahead Rebate Application Form

All information is required unless otherwise noted. Failure to complete all required information will result in delay or

rejection of your application. Please print legibly.

SECTION 1 - APPLICANT TYPE

Applicant type (select one): ☐ Individual

☐

Business

☐

State Government Agency

☐

Local Government Agency

☐ Nonprofit Organization ☐ Low-income Service Provider

(If you select “Individual”, please proceed to Section 2. All other options, proceed to Section 3)

SECTION 2 APPLICANT INFORMATION - INDIVIDUAL

First name (as shown on vehicle registration)

Last name (as shown on vehicle registration)

Driver license number

Phone number

Email address (required)

Residential address (Please enter the address where you resided at the time of purchase or lease of your vehicle. If you

have moved, please provide your current address as the mailing address.)

Street/Unit #

City

State

ZIP Code

Mailing address (Enter only if different from above address.)

Street/Unit #

City

State

ZIP Code

To be eligible for the Charge Ahead Rebate, your household income must be below 400% of the federal poverty

guideline. “Household” is defined as an individual living alone, a family with or without children, or a group of

individuals who are living together as one economic unit. Please visit the Income Eligibility Calculator on our website

to confirm eligibility.

Would you like to apply for the Charge Ahead Rebate based on the guidelines listed above?

(Select one) ☐ Yes ☐ No

(If you select Yes, please complete Section 2A. If you select No, please proceed to Section 4)

SECTION 2A - CHARGE AHEAD REBATE ELIGIBILITY (INDIVIDUAL)

Were you enrolled in one of these public assistance programs at the time you purchased or leased your vehicle? (Check

all that apply.)

☐ Oregon Health Plan / Medicaid ☐ SNAP (Include Acceptance Letter)

☐ Free- or Reduced-Price Lunch ☐ Temporary Assistance for Needy Families (TANF)

☐ HUD Housing Choice Voucher ☐ LIHEAP (Home Energy Assistance)

☐ Employment Related Daycare ☐ TriMet reduced fare program for low-income rider

☐ Women, Infants and Children (WIC) ☐ Individual Development Account (IDA) holder

(If you select any Public Assistance Program, proof of enrollment will be required once your application is received.)

What was your household income at the time you purchased or leased your vehicle?

$

“Household income” is your gross annual income which includes, but is not limited to wages, unemployment, workers'

compensation, Social Security, Supplemental Security Income, public assistance, veterans' payments, survivor benefits,

pension or retirement income, interest, dividends, rents, royalties, income from estates, trusts, educational assistance,

alimony, child support, assistance from outside the household, and any other sources of income.

What was your household size at the time you purchased or leased your vehicle?

Page 9 of 10 Updated : March 15, 2023

SECTION 3A APPLICANT INFORMATION - ORGANIZATIONS

Is this a fleet vehicle? (Select one)

☐

Yes, car share/rental vehicle ☐ Yes, public fleet vehicle ☐ No, not a fleet vehicle

Please complete the information for the authorized representative(s) of the organization. (If you are a sole

proprietorship, DBA or Trust, you must apply as an individual and complete Part 2.)

Primary contact first name

Primary contact last name

Primary contact phone

Primary contact email

Secondary contact first name

Secondary contact last name

Secondary contact phone

Secondary contact email

Organization name (as filed with the Oregon Secretary of State)

Tax Identification Number (TIN)

Street/Unit #

City

State

ZIP Code

Mailing address (Enter only if different from above address.)

Street/Unit #

City

State

ZIP Code

SECTION 3B – CHARGE AHEAD REBATE ELIGIBILITY (LOW-INCOME SERVICE PROVIDERS)

Are you a low-income service provider that provides health, dental, social, financial, energy conservation or other

assistive services to low- or moderate-income households in Oregon and registered as a 501(c)(3)?

☐ Yes

☐

No

SECTION 4 - VEHICLE INFORMATION

Please refer to the purchase or lease agreement for below information.

VEHICLE IDENTIFICATION NUMBER (VIN)

New or used? (Select one)

☐ New ☐ Used

MAKE

MODEL

YEAR

Purchase or lease? (Select one)

☐ Purchase ☐ Lease

Date of purchase or lease start date (MM/DD/YY)

(For Tesla and other vehicles without standard purchase/lease agreements, the date of first

registration is considered the date of purchase or lease.)

If leased, length of lease term in months

Leased vehicles with lease terms less than 24 months are ineligible.

Dealership name

Dealership phone number

Dealership contact name (Salesperson)

Dealer contact title

Page 10 of 10 Updated : March 15, 2023

SECTION 5 - SIGNATURE

(Please read, check all relevant boxes below and sign below.)

By signing this application, the Applicant agrees to the following: (Required for all applicants)

☐ I have read and agree to the Terms and Conditions.

☐ I certify under penalty of perjury that, to the best of my knowledge, the information provided in this

application and supporting documentation is accurate.

☐ I agree to provide my Personal Information (defined below) as part of this application, and understand and

agree that my Personal Information will be shared with the following parties for the following purposes:

1. The Center for Sustainable Energy, so they may contact me, process my rebate and enforce the

Program Terms and Conditions.

2. The Oregon Department of Environmental Quality (DEQ), Oregon DMV, and the Oregon Treasury to

administer the Program, distribute my rebate funds and enforce program Terms and Conditions.

3. Any other party pursuant to a public records request under which this rebate application is deemed a

“responsive record”, in which case DEQ may release some or all of my Personal Information to a third

party as required by Oregon law.

Personal Information may include, but is not limited to, an individual’s name, address, email address, social

security number, driver license number, household income, telephone number, racial identity, ethnicity, age and

gender identity.

FOR LOW-INCOME SERVICE PROVIDERS ONLY:

☐ I attest that I am a low-income service provider, as defined in Oregon Administrative Rule 340-270-

0030(8).

Signature of Applicant or Authorized Representative: ________________________________________

Date: _____________________

Mail this signed application form along with the required supporting documents to:

Center for Sustainable Energy

ATTN: Oregon Clean Vehicle Rebate Program

3980 Sherman Street, Suite 170, San Diego, CA 92110

Required documents:

☐ Proof of Oregon Residency

☐ I have provided a copy of my Oregon Driver’s License

☐ I do not have an Oregon Driver’s License and have provided approved alternative proof of residency (see page 6)

☐ Complete Purchase/Lease Agreement

☐ Proof of Vehicle Registration (temporary or permanent registration)

☐ Local business license, articles of incorporation, or other formation document filed with the Oregon Secretary of

State. (Business, nonprofit or local government only)

☐ 501(c)(3) nonprofit determination letter from IRS (Charge Ahead, Low-Income Service Providers Only)

Charge Ahead income documentation will be requested after the Center for Sustainable Energy receives the required

documents above. Do not submit the below information until requested by CSE.

☐ Household Summary Form (Charge Ahead Only)

☐ Proof of Income (Charge Ahead Only). Form 4506-C for each household resident OR proof of enrollment in a

Public Assistance Program